Ahead of an August 8 deadline set by US President Donald Trump for the Kremlin to stop the fighting in Ukraine, Washington is looking to squeeze Moscow economically and has found a new target: Russian oil sales to China.

Reining in how much oil China buys from Russia has become an unexpected sticking point in ongoing US-China trade talks in Stockholm, where both sides are looking to settle many of their differences in order to avert punishing tariffs and reach a broader trade deal.

With Trump growing increasingly frustrated with Russian President Vladimir Putin for spurning past efforts to broker peace in Ukraine, Washington is hoping to gain more leverage by denying Moscow billions in revenue.

"The administration has come to the realization of how important Russian oil sales to China are," Dennis Wilder, who was a top White House China adviser to former US President George W. Bush, told RFE/RL. "Without them, you can argue that the Russian economy would have already gone into a tailspin."

But getting Beijing to meet the US demand is proving difficult, with Chinese officials refusing to reduce the country's oil purchases during the ongoing talks. In response, US Treasury Secretary Scott Bessent has raised the possibility of a 100 percent tariff.

"China will always ensure its energy supply in ways that serve our national interests," China's Foreign Ministry posted on X last week, responding to the threat of further tariffs. "Coercion and pressuring will not achieve anything. China will firmly defend its sovereignty, security, and development interests."

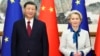

Former officials and energy analysts who spoke to RFE/RL say China is unlikely to stop buying Russian oil but could be willing to limit its purchases for a short period as a goodwill gesture while both Beijing and Washington look to strike an economic bargain that could be a precursor to a potential summit between Trump and Chinese leader Xi Jinping, which reportedly could take place in October.

"It's possible that Beijing could decide to subtly reduce their monthly imports of Russian oil, but I wouldn't expect them to completely cut them off or to publicly announce any change if they do," Wilder said.

Can The US Convince China To Stop Buying Russian Oil?

Whether Washington can get Beijing to cut back on Russian oil will depend on the complex US-China trade talks under way in Sweden that face an August 12 deadline to reach a deal.

Beyond pushing China on Russian oil, Washington has also demanded that Beijing stop purchasing oil from Iran, which is subject to US sanctions. Iran currently sends more than 90 percent of its oil exports to China.

Russia supplies approximately one-fifth of China's total oil, analysts say.

Trump has also ramped up pressure on India, which has shifted between first and second position alongside China as the top buyers of Russian oil since Moscow's full-scale invasion of Ukraine in February 2022.

In an August 4 post on Truth Social, Trump said he will be "substantially raising" tariffs on India over its purchases of Russian oil, having already threatened a 25 percent tariff on Indian goods.

Curbing Chinese and Indian purchases would be felt in Moscow, but Beijing also has cards to play against the United States, analysts say.

The White House is now actively encouraging China to buy more US products, including American technology. Trump and Bessent have also said they want China to make it easier for US businesses to operate and also increase Beijing's purchases of US energy.

But China has also used its dominant position in the flow of rare earths, an essential group of elements that are needed to manufacture everything from electric vehicle batteries to vital defense technology, to get concessions of its own.

This was underscored in July when the United States relaxed a ban on sales of jet engines and Nvidia's H20 artificial-intelligence chips in exchange for Beijing lifting restrictions on the sale of rare earths.

Pushing too hard on oil purchases could risk derailing some of the trade progress already made by US and Chinese negotiators.

"Beijing has demonstrated that its restrictions on exporting rare earths are a powerful weapon, and the US administration wouldn't want to jeopardize this fragile truce," Maria Shagina, a senior fellow at the International Institute for Strategic Studies, a London-based think-tank, told RFE/RL.

What Leverage Does Washington Have With China?

Beijing may also be hesitant to undertake any moves that could hurt Russia's war effort against Ukraine.

China has been one of Russia's closest backers, with Putin and Xi declaring a "no limits" partnership shortly before the Kremlin launched its full-scale invasion in February 2022. While Beijing has stopped short of sending lethal aid, Chinese firms have supplied the bulk of the dual-use products that have allowed Moscow to replenish its supply of missiles, drones, and other munitions throughout the war.

In July, Chinese Foreign Minister Wang Yi told EU foreign policy chief Kaja Kallas that Beijing couldn't accept Russia's defeat in the war as it would free up Washington to focus on China. The comments were first reported by the South China Morning Post and later confirmed by RFE/RL.

Experts say a bipartisan bill introduced in the US Senate could also factor in as a negotiating tool for Washington against Beijing.

The legislation would impose tariffs of up to 500 percent on countries that support Russia’s war machine by buying its oil and gas, with China and India as the two main targets. But enacting such measures, should the bill be passed by Congress, would escalate tensions sharply.

In the meantime, Beijing is weighing its options, including limiting oil purchases from Russia but also looking to entice the Trump administration with promises to invest more in the United States and to increase sales of US energy and agricultural products.

Joe Webster, an expert of China and Russia’s energy relationship at the US-based Atlantic Council think tank, says that it’s more likely to see Beijing increase purchases of US energy than to cut back on buying Russian oil.

"Increasing US exports is a fairly straightforward step [China] could take," he told RFE/RL. "Reducing imports from Russia is more of a challenge, as that could still lead to real material pain for Russia, and Beijing clearly does not want Moscow to lose the war."

But even that could be met with hesitation from Beijing.

Chinese officials have long worried that the United States and its allies could hamstring the nation's economy by choking off its supply of foreign oil, leading to China investing hundreds of billions of dollars into boosting its own domestic production and building the world’s top electric-vehicle industry.

"Beijing doesn't seek dependency on anyone, including Russia, but especially the United States," Webster said. "This will be met with reluctance."